Finance is not merely prone to crises, it is shaped by them. Five historical crises show how aspects of today’s financial system originated—and offer lessons for today’s regulators

What is mankind’s greatest invention? Ask people this question and they are likely to pick familiar technologies such as printing or electricity. They are unlikely to suggest an innovation that is just as significant: the financial contract. Widely disliked and often considered grubby, it has nonetheless played an indispensable role in human development for at least 7,000 years.

At its core, finance does just two simple things. It can act as an economic time machine, helping savers transport today’s surplus income into the future, or giving borrowers access to future earnings now. It can also act as a safety net, insuring against floods, fires or illness. By providing these two kinds of service, a well-tuned financial system smooths away life’s sharpest ups and downs, making an uncertain world more predictable. In addition, as investors seek out people and companies with the best ideas, finance acts as an engine of growth.

Yet finance can also terrorise. When bubbles burst and markets crash, plans paved years into the future can be destroyed. As the impact of the crisis of 2008 subsides, leaving its legacy of unemployment and debt, it is worth asking if the right things are being done to support what is good about finance, and to remove what is poisonous.

History is a good place to look for answers. Five devastating slumps—starting with America’s first crash, in 1792, and ending with the world’s biggest, in 1929—highlight two big trends in financial evolution. The first is that institutions that enhance people’s economic lives, such as central banks, deposit insurance and stock exchanges, are not the products of careful design in calm times, but are cobbled together at the bottom of financial cliffs. Often what starts out as a post-crisis sticking plaster becomes a permanent feature of the system. If history is any guide, decisions taken now will reverberate for decades.

This makes the second trend more troubling. The response to a crisis follows a familiar pattern. It starts with blame. New parts of the financial system are vilified: a new type of bank, investor or asset is identified as the culprit and is then banned or regulated out of existence. It ends by entrenching public backing for private markets: other parts of finance deemed essential are given more state support. It is an approach that seems sensible and reassuring.

Advertisement

But it is corrosive. Walter Bagehot, editor of this newspaper between 1860 and 1877, argued that financial panics occur when the “blind capital” of the public floods into unwise speculative investments. Yet well-intentioned reforms have made this problem worse. The sight of Britons stuffing Icelandic banks with sterling, safe in the knowledge that £35,000 of deposits were insured by the state, would have made Bagehot nervous. The fact that professional investors can lean on the state would have made him angry.

These five crises reveal where the titans of modern finance—the New York Stock Exchange, the Federal Reserve, Britain’s giant banks—come from. But they also highlight the way in which successive reforms have tended to insulate investors from risk, and thus offer lessons to regulators in the current post-crisis era.

If one man deserves credit for both the brilliance and the horrors of modern finance it is Alexander Hamilton, the first Treasury secretary of the United States. In financial terms the young country was a blank canvas: in 1790, just 14 years after the Declaration of Independence, it had five banks and few insurers. Hamilton wanted a state-of-the-art financial set-up, like that of Britain or Holland. That meant a federal debt that would pull together individual states’ IOUs. America’s new bonds would be traded in open markets, allowing the government to borrow cheaply. And America would also need a central bank, the First Bank of the United States (BUS), which would be publicly owned.

This new bank was an exciting investment opportunity. Of the $10m in BUS shares, $8m were made available to the public. The initial auction, in July 1791, went well and was oversubscribed within an hour. This was great news for Hamilton, because the two pillars of his system—the bank and the debt—had been designed to support each other. To get hold of a $400 BUS share, investors had to buy a $25 share certificate or “scrip”, and pay three-quarters of the remainder not in cash, but with federal bonds. The plan therefore stoked demand for government debt, while also furnishing the bank with a healthy wedge of safe assets. It was seen as a great deal: scrip prices shot up from $25 to reach more than $300 in August 1791. The bank opened that December.

Two things put Hamilton’s plan at risk. The first was an old friend gone bad, William Duer. The scheming old Etonian was the first Englishman to be blamed for an American financial crisis, but would not be the last. Duer and his accomplices knew that investors needed federal bonds to pay for their BUS shares, so they tried to corner the market. To fund this scheme Duer borrowed from wealthy friends and, by issuing personal IOUs, from the public. He also embezzled from companies he ran.

The other problem was the bank itself. On the day it opened it dwarfed the nation’s other lenders. Already massive, it then ballooned, making almost $2.7m in new loans in its first two months. Awash with credit, the residents of Philadelphia and New York were gripped by speculative fever. Markets for short sales and futures contracts sprang up. As many as 20 carriages a week raced between the two cities to exploit opportunities for arbitrage.

The jitters began in March 1792. The BUS began to run low on the hard currency that backed its paper notes. It cut the supply of credit almost as quickly as it had expanded it, with loans down by 25% between the end of January and March. As credit tightened, Duer and his cabal, who often took on new debts in order to repay old ones, started to feel the pinch.

Rumours of Duer’s troubles, combined with the tightening of credit by the BUS, sent America’s markets into sharp descent. Prices of government debt, BUS shares and the stocks of the handful of other traded companies plunged by almost 25% in two weeks. By March 23rd Duer was in prison. But that did not stop the contagion, and firms started to fail. As the pain spread, so did the anger. A mob of angry investors pounded the New York jail where Duer was being held with stones.

Hamilton knew what was at stake. A student of financial history, he was aware that France’s crash in 1720 had hobbled its financial system for years. And he knew Thomas Jefferson was waiting in the wings to dismantle all he had built. His response, as described in a 2007 paper by Richard Sylla of New York University, was America’s first bank bail-out. Hamilton attacked on many fronts: he used public money to buy federal bonds and pep up their prices, helping protect the bank and speculators who had bought at inflated prices. He funnelled cash to troubled lenders. And he ensured that banks with collateral could borrow as much as they wanted, at a penalty rate of 7% (then the usury ceiling).

Even as the medicine was taking effect, arguments about how to prevent future slumps had started. Everyone agreed that finance had become too frothy. Seeking to protect naive amateurs from risky investments, lawmakers sought outright bans, with rules passed in New York in April 1792 outlawing public futures trading. In response to this aggressive regulation a group of 24 traders met on Wall Street—under a Buttonwood tree, the story goes—to set up their own private trading club. That group was the precursor of the New York Stock Exchange.

Hamilton’s bail-out worked brilliantly. With confidence restored, finance flowered. Within half a century New York was a financial superpower: the number of banks and markets shot up, as did GDP. But the rescue had done something else too. By bailing out the banking system, Hamilton had set a precedent. Subsequent crises caused the financial system to become steadily more reliant on state support.

Crises always start with a new hope. In the 1820s the excitement was over the newly independent Latin American countries that had broken free from Spain. Investors were especially keen in Britain, which was booming at the time, with exports a particular strength. Wales was a source of raw materials, cutting 3m tonnes of coal a year, and sending pig iron across the globe. Manchester was becoming the world’s first industrial city, refining raw inputs into higher-value wares like chemicals and machinery. Industrial production grew by 34% between 1820 and 1825.

As a result, cash-rich Britons wanted somewhere to invest their funds. Government bonds were in plentiful supply given the recent Napoleonic wars, but with hostilities over (and risks lower) the exchequer was able to reduce its rates. The 5% return paid on government debt in 1822 had fallen to 3.3% by 1824. With inflation at around 1% between 1820 and 1825 gilts offered only a modest return in real terms. They were safe but boring.

Luckily investors had a host of exotic new options. By the 1820s London had displaced Amsterdam as Europe’s main financial hub, quickly becoming the place where foreign governments sought funds. The rise of the new global bond market was incredibly rapid. In 1820 there was just one foreign bond on the London market; by 1826 there were 23. Debt issued by Russia, Prussia and Denmark paid well and was snapped up.

But the really exciting investments were those in the new world. The crumbling Spanish empire had left former colonies free to set up as independent nations. Between 1822 and 1825 Colombia, Chile, Peru, Mexico and Guatemala successfully sold bonds worth £21m ($2.8 billion in today’s prices) in London. And there were other ways to cash in: the shares of British mining firms planning to explore the new world were popular. The share price of one of them, Anglo Mexican, went from £33 to £158 in a month.

The big problem with all this was simple: distance. To get to South America and back in six months was good going, so deals were struck on the basis of information that was scratchy at best. The starkest example were the “Poyais” bonds sold by Gregor MacGregor on behalf of a new country that did not, in fact, exist. This shocking fraud was symptomatic of a deeper rot. Investors were not carrying out proper checks. Much of the information about new countries came from journalists paid to promote them. More discerning savers would have asked tougher questions: Mexico and Colombia were indeed real countries, but had only rudimentary tax systems, so they stood little chance of raising the money to make the interest payments on their new debt.

Investors were also making outlandish assumptions. Everyone knew that rivalry with Spain meant that Britain’s government supported Latin American independence. But the money men took another step. Because Madrid’s enemy was London’s friend, they reasoned, the new countries would surely be able to lean on Britain for financial backing. With that backstop in place the Mexican and Colombian bonds, which paid 6%, seemed little more risky than 3% British gilts. Deciding which to buy was simple.

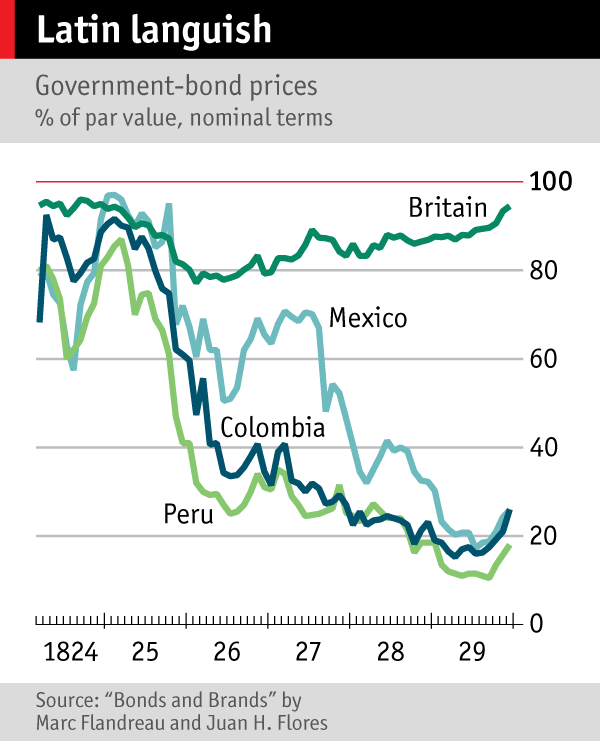

But there would be no British support for these new countries. In the summer of 1823 it became clear that Spain was on the verge of default. As anxiety spread, bond prices started to plummet. Research by Marc Flandreau of the Geneva Graduate Institute and Juan Flores of the University of Geneva shows that by the end of 1825 Peru’s bonds had fallen to 40% of their face value, with others following them down.

Britain’s banks, exposed to the debt and to mining firms, were hit hard. Depositors began to scramble for cash: by December 1825 there were bank runs. The Bank of England jumped to provide funds both to crumbling lenders and directly to firms in a bail-out that Bagehot later regarded as the model for crisis-mode central banking. Despite this many banks were unable to meet depositors’ demands. In 1826 more than 10% of the banks in England and Wales failed. Britain’s response to the crash would change the shape of banking.

The most remarkable thing about the crisis of 1825 was the sharp divergence in views on what should be done about it. Some blamed investors’ sloppiness: they had invested in unknown countries’ debt, or in mining outfits set up to explore countries that contained no ores. A natural reaction to this emerging-markets crisis might have been to demand that investors conduct proper checks before putting money at risk.

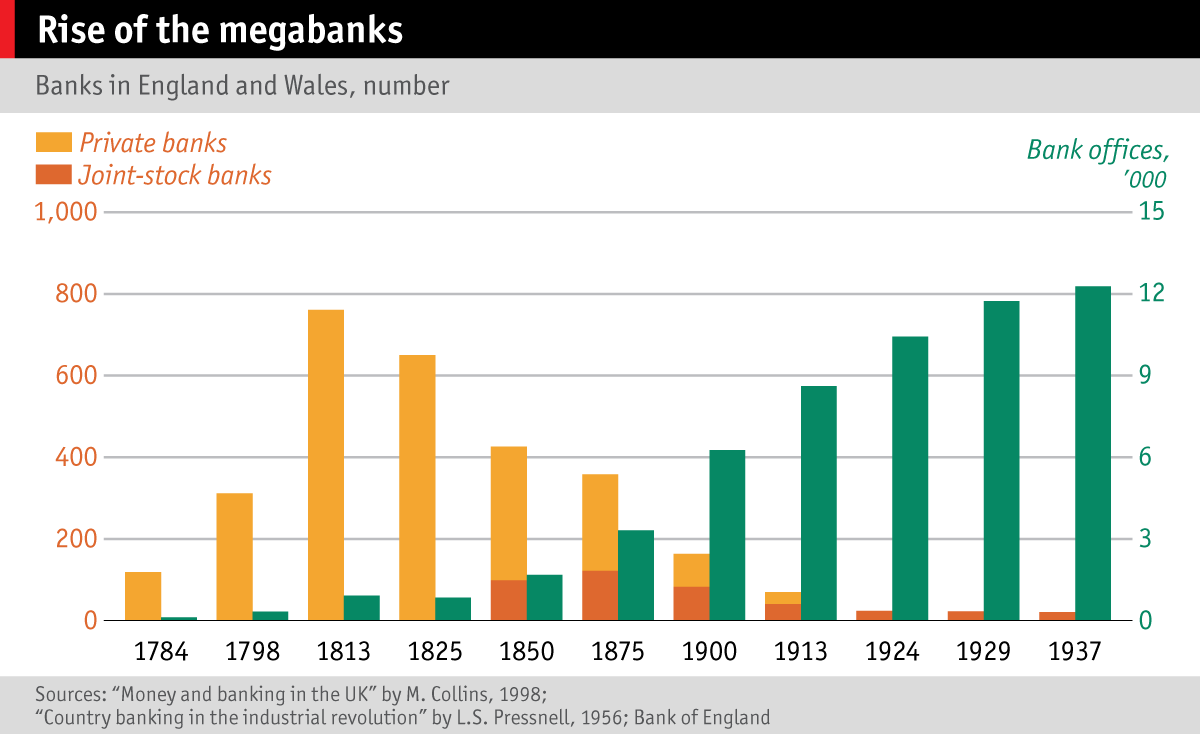

But Britain’s financial chiefs, including the Bank of England, blamed the banks instead. Small private partnerships akin to modern private-equity houses, they were accused of stoking up the speculative bubble with lax lending. Banking laws at the time specified that a maximum of six partners could supply the equity, which ensured that banks were numerous but small. Had they only been bigger, it was argued, they would have had sufficient heft to have survived the inevitable bust.

Mulling over what to do, the committees of Westminster and Threadneedle Street looked north, to Scotland. Its banks were “joint stock” lenders that could have as many partners as they wanted, issuing equity to whoever would buy it. The Scottish lenders had fared much better in the crisis. Parliament passed a new banking act copying this set-up in 1826. England was already the global hub for bonds. With ownership restrictions lifted, banks like National Provincial, now part of RBS, started gobbling up rivals, a process that has continued ever since.

The shift to joint-stock banking is a bittersweet moment in British financial history. It had big upsides: the ancestors of the modern megabank had been born, and Britain became a world leader in banking as well as bonds. But the long chain of mergers it triggered explains why RBS ended up becoming the world’s largest bank—and, in 2009, the largest one to fail. Today Britain’s big four banks hold around 75% of the country’s deposits, and the failure of any one of them would still pose a systemic risk to the economy.

By the mid-19th century the world was getting used to financial crises. Britain seemed to operate on a one-crash-per-decade rule: the crisis of 1825-26 was followed by panics in 1837 and 1847. To those aware of the pattern, the crash of 1857 seemed like more of the same. But this time things were different. A shock in America’s Midwest tore across the country and jumped from New York to Liverpool and Glasgow, and then London. From there it led to crashes in Paris, Hamburg, Copenhagen and Vienna. Financial collapses were not merely regular—now they were global, too.

On the surface, Britain was doing well in the 1850s. Exports to the rest of the world were booming, and resources increased with gold discoveries in Australia. But beneath the surface two big changes were taking place. Together they would create what this newspaper, writing in 1857, called “a crisis more severe and more extensive than any which had preceded it”.

The first big change was that a web of new economic links had formed. In part, they were down to trade. By 1857 America was running a $25m current-account deficit, with Britain and its colonies as its major trading partners. Americans bought more goods than they sold, with Britain buying American assets to provide the funds, just as China does today. By the mid-1850s Britain held an estimated $80m in American stocks and bonds.

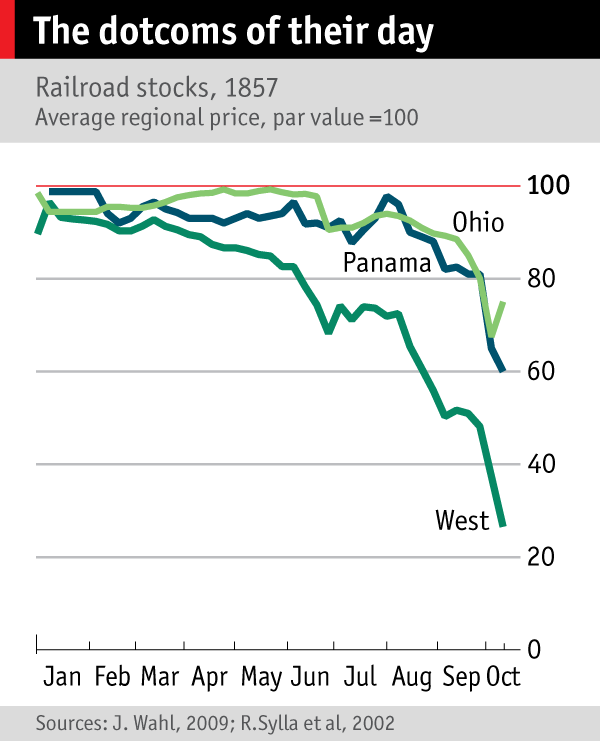

Railway companies were a popular investment. Shares of American railway firms such as the Illinois Central and the Philadelphia and Reading were so widely held by British investors that Britons sat on their boards. That their earnings did not justify their valuations did not matter much: they were a bet on future growth.

The second big change was a burst of financial innovation. As Britain’s aggressive joint-stock banks gobbled up rivals, deposits grew by almost 400% between 1847 and 1857. And a new type of lender—the discount house—was mushrooming in London. These outfits started out as middlemen, matching investors with firms that needed cash. But as finance flowered the discount houses morphed, taking in investors’ cash with the promise that it could be withdrawn at will, and hunting for firms to lend to. In short, they were banks in all but name.

Competition was fierce. Because joint-stock banks paid depositors the Bank of England’s rate less one percentage point, any discount house paying less than this would fail to attract funds. But because the central bank was also an active lender, discounting the best bills, its rate put a cap on what the discount houses could charge borrowers. With just one percentage point to play with, the discount houses had to be lean. Since cash paid zero interest, they cut their reserves close to zero, relying on the fact that they could always borrow from the Bank of England if they faced large depositor withdrawals. Perennially facing the squeeze, London’s new financiers trimmed away their capital buffers.

Meanwhile in America, Edward Ludlow, the manager of Ohio Life, an insurance company, became caught up in railway fever. New lines were being built to link eastern cities with new frontier towns. Many invested heavily but Ludlow went all in, betting $3m of Ohio Life’s $4.8m on railway companies. One investment alone, in the Cleveland and Pittsburgh line, accounted for a quarter of the insurer’s capital.

In late spring 1857, railroad stocks began to drop. Ohio Life, highly leveraged and overexposed, fell faster, failing on August 24th. As research by Charles Calomiris of Columbia University and Larry Schweikart of Dayton University shows, problems spread eastwards, dragging down stockbrokers that had invested in railways. When banks dumped their stock, prices fell further, magnifying losses. By October 13th Wall Street was packed with depositors demanding their money. The banks refused to convert deposits into currency. America’s financial system had failed.

As the financial dominoes continued to topple, the first British cities to suffer were Glasgow and Liverpool. Merchants who traded with American firms began to fail in October. There were direct financial links, too. Dennistoun, Cross and Co., an American bank that had branches in Liverpool, Glasgow, New York and New Orleans, collapsed on November 7th, taking with it the Western Bank of Scotland. That made the British crisis systemic: the bank had 98 branches and held £5m in deposits. There was “wild panic” with troops needed to calm the crowds.

The discount houses magnified the problem. They had become a vital source of credit for firms. But investors were suspicious of their balance-sheets. They were right to be: one reported £10,000 of capital supporting risky loans of £900,000, a leverage ratio that beats even modern excesses. As the discount houses failed, so did ordinary firms. In the last three months of 1857 there were 135 bankruptcies, wiping out investor capital of £42m. Britain’s far-reaching economic and financial tentacles meant this caused panics across Europe.

As well as being global, the crash of 1857 marked another first: the recognition that financial safety nets can create excessive risk-taking. The discount houses had acted in a risky way, holding few liquid assets and small capital buffers in part because they knew they could always borrow from the Bank of England. Unhappy with this, the Bank changed its policies in 1858. Discount houses could no longer borrow on a whim. They would have to self-insure, keeping their own cash reserves, rather than relying on the central bank as a backstop. That step made the 1857 crisis an all-too-rare example of the state attempting to dial back its support. It also shows how unpopular cutting subsidies can be.

The Bank of England was seen to be “obsessed” by the way discount houses relied on it, and to have rushed into its reforms. The Economist thought its tougher lending policy unprincipled: we argued that decisions should be made on a case-by-case basis, rather than applying blanket bans. Others thought the central bank lacked credibility, as it would never allow a big discount house to fail. They were wrong. In 1866 Overend & Gurney, by then a huge lender, needed emergency cash. The Bank of England refused to rescue it, wiping out its shareholders. Britain then enjoyed 50 years of financial calm, a fact that some historians reckon was due to the prudence of a banking sector stripped of moral hazard.

As the 20th century dawned America and Britain had very different approaches to banking. The Bank of England was all-powerful, a tough overseer of a banking system it had helped design. America was the polar opposite. Hamilton’s BUS had closed in 1811 and its replacement, just around the corner in Philadelphia, was shut down in 1836. An atomised, decentralised system developed. Americans thought banks could look after themselves—until the crisis of 1907.

The absence of a lender of last resort had certainly not crimped the expansion of banking. The period after the civil war saw an explosion in the number of banks. By 1907 America had 22,000 banks—one for every 4,000 people. In most towns, there was a choice of local banks or state-owned lenders.

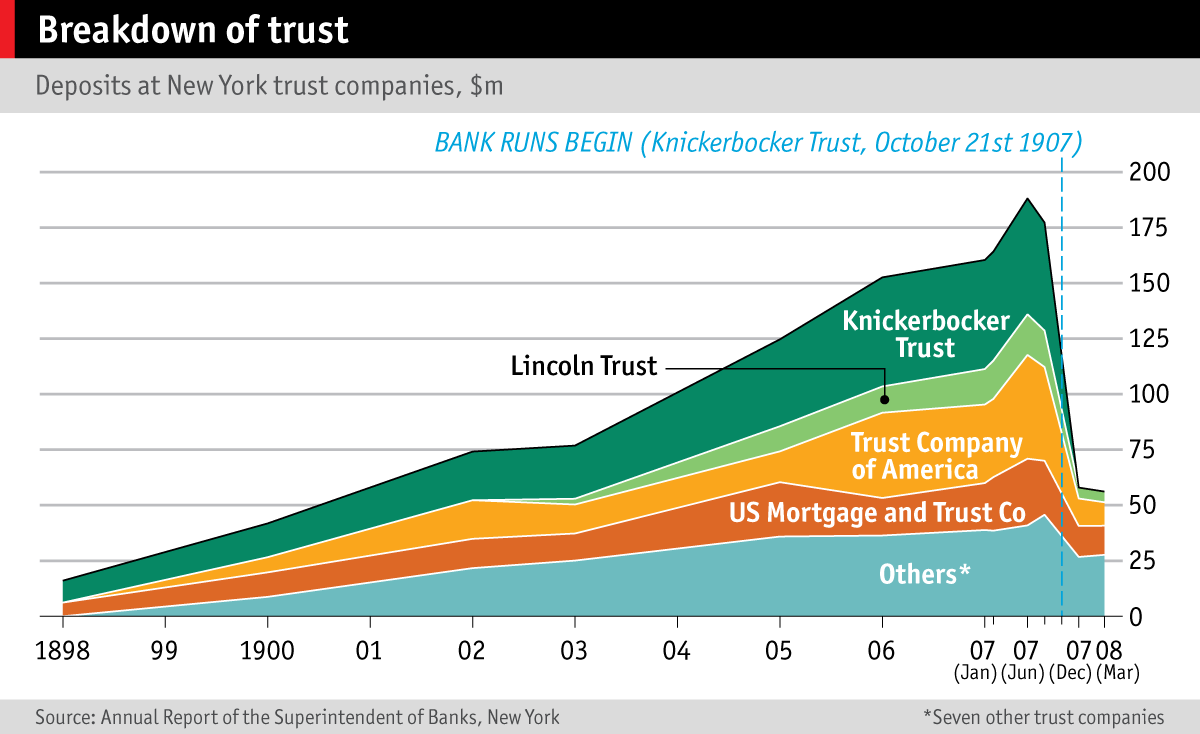

Despite all these options, savvy metropolitan investors tended to go elsewhere—to the trust companies. These outfits appeared in the early 1890s to act as “trustees”, holding their customers’ investments in bonds and stocks. By 1907 they were combining this safehouse role with riskier activities: underwriting and distributing shares, and owning and managing property and railways. They also took in deposits. The trust companies had, in short, become banks.

And they were booming. Compared with ordinary banks, they invested in spicier assets and were more lightly regulated. Whereas banks had to hold 25% of their assets as cash (in case of sudden depositor demands) the trusts faced a 5% minimum. Able to pay higher rates of interest to depositors, they became a favourite place to park large sums. By 1907 they were almost as big as the national banks, having grown by nearly 250% in ten years.

America was buzzing too. Between 1896 and 1906 its average annual growth rate was almost 5%. This was extraordinary, given that America faced catastrophes such as the Baltimore fire of 1904 and San Francisco earthquake of 1906, which alone wiped out around 2% of GDP. All Americans, you might think, would have been grateful that things stayed on track.

But two greedy scammers—Augustus Heinze and Charles Morse—wanted more, as a 1990 paper by Federal Reserve economists Ellis Tallman and Jon Moen shows. The two bankers had borrowed and embezzled vast sums in an attempt to corner the market in the shares of United Copper. But the economy started to slow a little in 1907, depressing the prices of raw materials, including metals. United Copper’s shares fell in response. With the prices of their stocks falling Heinze and Morse faced losses magnified by their huge leverage. To prop up the market, they began to tap funds from the banks they ran. This whipped up trouble for a host of smaller lenders, sparking a chain of losses that eventually embroiled a trust company, the Knickerbocker Trust.

A Manhattan favourite located on the corner of 34th Street and 5th Avenue, its deposits had soared from $10m in 1897 to over $60m in 1907, making it the third-largest trust in America. Its Corinthian columns stood out even alongside its neighbour, the Waldorf Astoria. The exterior marble was from Vermont; the interior marble was from Norway. It was a picture of wealth and solidity.

Yet on the morning of October 22nd the Knickerbocker might as well have been a tin shack. When news emerged that it was caught up in the Heinze-Morse financial contagion, depositors lined the street demanding cash. The Knickerbocker paid out $8m in less than a day, but had to refuse some demands, casting a pall over other trusts. The Trust Company of America was the next to suffer a depositor run, followed by the Lincoln Trust. Some New Yorkers moved cash from one trust to another as they toppled. When it became clear that the financial system was unsafe, Americans began to hoard cash at home.

For a while it looked as though the crisis could be nipped in the bud. After all, the economic slowdown had been small, with GDP still growing by 1.9% in 1907. And although there were crooks like Heinze and Morse causing trouble, titans like John Pierpont Morgan sat on the other side of the ledger. As the panic spread and interest rates spiked to 125%, Morgan stepped in, organising pools of cash to help ease the strain. At one point he locked the entire New York banking community in his library until a $25m bail-out fund had been agreed.

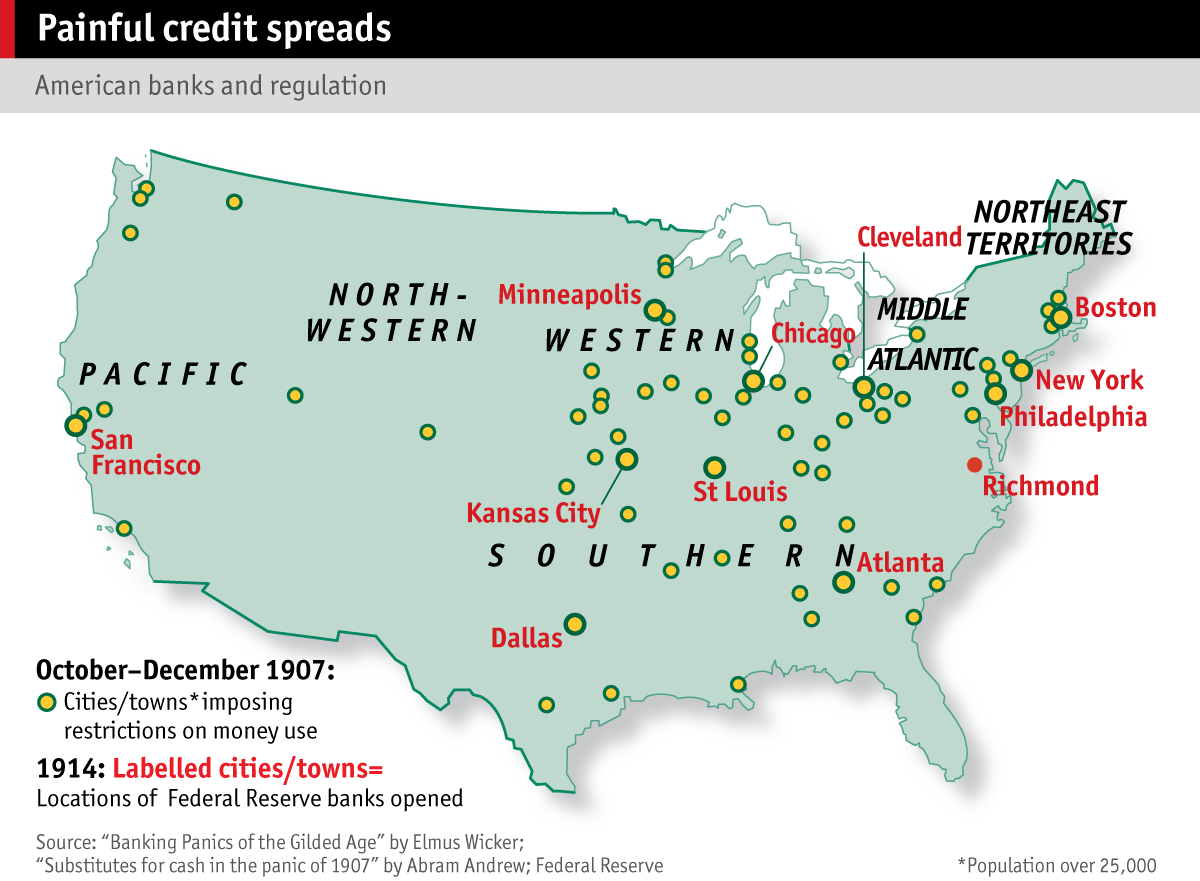

But it was not enough. Depositors across the country began runs on their banks. Sensing imminent collapse, states declared emergency holidays. Those that remained open limited withdrawals. Despite the robust economy, the crash in New York led to a nationwide shortage of money. This hit business hard, with national output dropping a staggering 11% between 1907 and 1908.

With legal tender so scarce alternatives quickly sprang up. In close to half of America’s large towns and cities, cash substitutes started to circulate. These included cheques and small-denomination IOUs written by banks. The total value of this private-sector emergency cash—all of it illegal—was around $500m, far bigger than the Morgan bail-out. It did the trick, and by 1909 the American economy was growing again.

The earliest proposals for reform followed naturally from the cash shortage. A plan for $500m of official emergency money was quickly put together. But the emergency-money plan had a much longer-lasting impact. The new currency laws included a clause to set up a committee—the National Monetary Commission—that would discuss the way America’s money worked. The NMC sat for four years, examining evidence from around the world on how best to reshape the system. It concluded that a proper lender of last resort was needed. The result was the 1913 Federal Reserve Act, which established America’s third central bank in December that year. Hamilton had belatedly got his way after all.

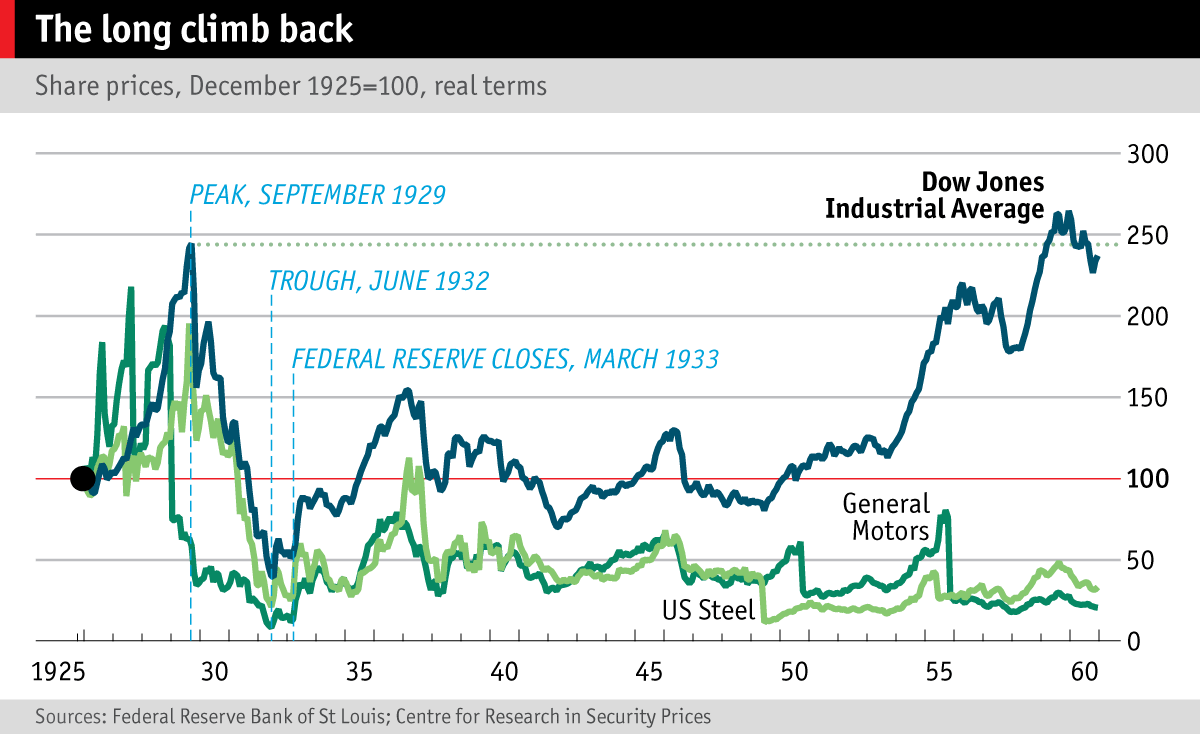

Until the eve of the 1929 slump—the worst America has ever faced—things were rosy. Cars and construction thrived in the roaring 1920s, and solid jobs in both industries helped lift wages and consumption. Ford was making 9,000 of its Model T cars a day, and spending on new-build homes hit $5 billion in 1925. There were bumps along the way (1923 and 1926 saw slowdowns) but momentum was strong.

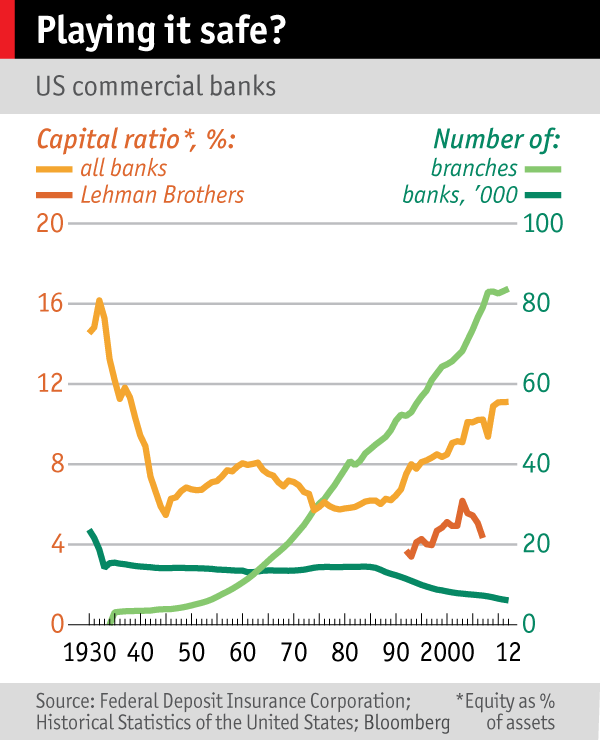

Banks looked good, too. By 1929 the combined balance-sheets of America’s 25,000 lenders stood at $60 billion. The assets they held seemed prudent: just 60% were loans, with 15% held as cash. Even the 20% made up by investment securities seemed sensible: the lion’s share of holdings were bonds, with ultra-safe government bonds making up more than half. With assets of such high quality the banks allowed the capital buffers that protected them from losses to dwindle.

But as the 1920s wore on the young Federal Reserve faced a conundrum: share prices and prices in the shops started to move in opposite directions. Markets were booming, with the shares of firms exploiting new technologies—radios, aluminium and aeroplanes—particularly popular. But few of these new outfits had any record of dividend payments, and investors piled into their shares in the hope that they would continue to increase in value. At the same time established businesses were looking weaker as consumer prices fell. For a time the puzzle—whether to raise rates to slow markets, or cut them to help the economy—paralysed the Fed. In the end the market-watchers won and the central bank raised rates in 1928.

It was a catastrophic error. The increase, from 3.5% to 5%, was too small to blunt the market rally: share prices soared until September 1929, with the Dow Jones index hitting a high of 381. But it hurt America’s flagging industries. By late summer industrial production was falling at an annualised rate of 45%. Adding to the domestic woes came bad news from abroad. In September the London Stock Exchange crashed when Clarence Hatry, a fraudulent financier, was arrested. A sell-off was coming. It was huge: over just two days, October 28th and 29th, the Dow lost close to 25%. By November 13th it was at 198, down 45% in two months.

Worse was to come. Bank failures came in waves. The first, in 1930, began with bank runs in agricultural states such as Arkansas, Illinois and Missouri. A total of 1,350 banks failed that year. Then a second wave hit Chicago, Cleveland and Philadelphia in April 1931. External pressure worsened the domestic worries. As Britain dumped the Gold Standard its exchange rate dropped, putting pressure on American exporters. There were banking panics in Austria and Germany. As public confidence evaporated, Americans again began to hoard currency. A bond-buying campaign by the Federal Reserve brought only temporary respite, because the surviving banks were in such bad shape.

This became clear in February 1933. A final panic, this time national, began to force more emergency bank holidays, with lenders in Nevada, Iowa, Louisiana and Michigan the first to shut their doors. The inland banks called in inter-bank deposits placed with New York lenders, stripping them of $760m in February 1933 alone. Naturally the city bankers turned to their new backstop, the Federal Reserve. But the unthinkable happened. On March 4th the central bank did exactly what it had been set up to prevent. It refused to lend and shut its doors. In its mission to act as a source of funds in all emergencies, the Federal Reserve had failed. A week-long bank holiday was called across the nation.

It was the blackest week in the darkest period of American finance. Regulators examined banks’ books, and more than 2,000 banks that closed that week never opened again. After this low, things started to improve. Nearly 11,000 banks had failed between 1929 and 1933, and the money supply dropped by over 30%. Unemployment, just 3.2% on the eve of the crisis, rose to more than 25%; it would not return to its previous lows until the early 1940s. It took more than 25 years for the Dow to reclaim its peak in 1929.

Reform was clearly needed. The first step was to de-risk the system. In the short term this was done through a massive injection of publicly supplied capital. The $1 billion boost—a third of the system’s existing equity—went to more than 6,000 of the remaining 14,000 banks. Future risks were to be neutralised by new legislation, the Glass-Steagall rules that separated stockmarket operations from more mundane lending and gave the Fed new powers to regulate banks whose customers used credit for investment.

A new government body was set up to deal with bank runs once and for all: the Federal Deposit Insurance Commission (FDIC), established on January 1st 1934. By protecting $2,500 of deposits per customer it aimed to reduce the costs of bank failure. Limiting depositor losses would protect income, the money supply and buying power. And because depositors could trust the FDIC, they would not queue up at banks at the slightest financial wobble.

In a way, it worked brilliantly. Banks quickly started advertising the fact that they were FDIC insured, and customers came to see deposits as risk-free. For 70 years, bank runs became a thing of the past. Banks were able to reduce costly liquidity and equity buffers, which fell year on year. An inefficient system of self-insurance fell away, replaced by low-cost risk-sharing, with central banks and deposit insurance as the backstop.

Yet this was not at all what Hamilton had hoped for. He wanted a financial system that made government more stable, and banks and markets that supported public debt to allow infrastructure and military spending at low rates of interest. By 1934 the opposite system had been created: it was now the state’s job to ensure that the financial system was stable, rather than vice versa. By loading risk onto the taxpayer, the evolution of finance had created a distorting subsidy at the heart of capitalism.

The recent fate of the largest banks in America and Britain shows the true cost of these subsidies. In 2008 Citigroup and RBS Group were enormous, with combined assets of nearly $6 trillion, greater than the combined GDP of the world’s 150 smallest countries. Their capital buffers were tiny. When they ran out of capital, the bail-out ran to over $100 billion. The overall cost of the banking crisis is even greater—in the form of slower growth, higher debt and poorer employment prospects that may last decades in some countries.

But the bail-outs were not a mistake: letting banks of this size fail would have been even more costly. The problem is not what the state does, but that its hand is forced. Knowing that governments must bail out banks means parts of finance have become a one-way bet. Banks’ debt is a prime example. The IMF recently estimated that the world’s largest banks benefited from implicit government subsidies worth a total of $630 billion in the year 2011-12. This makes debt cheap, and promotes leverage. In America, meanwhile, there are proposals for the government to act as a backstop for the mortgage market, covering 90% of losses in a crisis. Again, this pins risk on the public purse. It is the same old pattern.

To solve this problem means putting risk back into the private sector. That will require tough choices. Removing the subsidies banks enjoy will make their debt more expensive, meaning equity holders will lose out on dividends and the cost of credit could rise. Cutting excessive deposit insurance means credulous investors who put their nest-eggs into dodgy banks could see big losses.

As regulators implement a new round of reforms in the wake of the latest crisis, they have an opportunity to reverse the trend towards ever-greater entrenchment of the state’s role in finance. But weaning the industry off government support will not be easy. As the stories of these crises show, hundreds of years of financial history have been pushing in the other direction.